Debunk Tuesday: Three frugality tips that have it all wrong

Occasionally, YCD aims to turn common wisdom on its head. This week we’ll see why three of the most common tips from frugality blogs are nonsense.

Google “how to save money” and you’ll come up with a bazillion lists of things to do to cut your expenses. Included among such nonsense suggestions as using rewards programs at coffee shops and printing graph paper are a few pretty consistent suggestions. Some are great, and we’ll cover those in the days ahead. Others seem to be repeated as if gospel despite the fact that they crumble under a little thoughtful scrutiny. Here are debunks of three seemingly smart pieces of advice that you’ll encounter over and over.

1. Don’t make a grocery list.

If your impulse control is so out of whack that an unscripted trip to the grocery store for you looks like this:

…then you have other issues. I find it laughable that so many so-called frugality lists are resigned to the idea that people are powerless in the face of choice at the grocery store and without a specific list will have to rent a trailer to haul home their impulse purchases of Listerine and cool ranch Doritos. The solution is not to blind yourself to things not on your list but to empower yourself to make smart choices. You can’t assume you know about every discount from the ads, and you can’t assume you know every item a store sells, so why think you can build a perfect list based on imperfect knowledge? It’s like trying to build an entire theology around 3 John.

When you come across something in a store that’s deeply discounted, weigh the cost vs. something you were going to purchase anyway. Can you replace a component in one of your planned meals with the cheaper option? Can you build a meal around the cheap thing without adding anything to your list? Can you freeze or store the cheap thing until such time as you can figure out what to do with it?

2. Don’t use a budget.

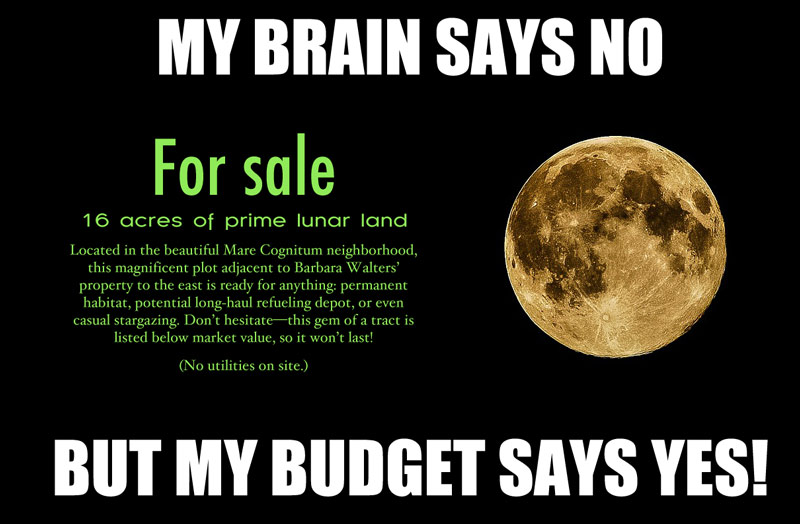

Seriously, what’s the point?

Let’s say you’ve followed Ms. Good Money Blog Gal and preemptively sorted all your expected expenses and given yourself $100 a month for fun. You go to a movie and spend $30 on tickets and snacks early in the month. Now pretend it’s the 29th of the month and a friend invites you out to a trendy restaurant that you’d normally scorn because its entrees start at $45 and only go up from there. But you’ve got $70 to spend by tomorrow! You can’t waste that budget! It’s completely OK because you planned for this and you deserve a reward for being so frugal for the last four weeks!

Answer me honestly. Are you more or less likely to go out to eat if you’ve already got money put aside for it?

“I have the money so it’s OK to spend it” is maybe the most mortifying piece of financial advice I’ve ever heard, and it’s the inevitable result of budgeting. The trouble is that budgeting allows you to skimp on the intellectual exercise of consciously considering every purchasing decision. It makes you financially lazy. Budgeting says that all you have to do is stay under a given amount of money and you win. Uh-huh. And don’t worry about smoking—as long as you’re not currently dying of lung cancer, you’re winning!

3. Don’t buy a house.

Contemporary wisdom says you should purchase a house if you plan to be there for five or more years. There’s a lot to be said for that, and I own a house myself. But I highly recommend renting as long as possible for three reasons.

- You have many more choices about where you live. If there’s any chance your career, relationship status, or financial position could change significantly, you’ll be much better able to adapt if you’re not tied to a house.

- Utilities suck. Where I’m from, apartment dwellers typically don’t pay directly for water, sewer, and garbage service. House owners (and house renters too) do. For my area that totals $151.37 every month, which is about 1/5 the cost of a good 2-bedroom apartment. (Bonus tip: If you pay for garbage service, downgrade your trash can. In many places you’re defaulted to the largest size, but you can often change to a smaller container.) Yes, you’re indirectly paying for them through your rent, but if you’re in a multi-unit building that cost is being spread out among several tenants.

- Opportunity costs. When you own a home, you’ve got to take care of it. If you have any kind of land at all (lawn, garden, miniature cow grazing pasture), you’ve got to maintain it. Is it worth the money to buy a lawnmower (even a cheap one) and invest the time every week or so to mow? What about when your kitchen garbage disposal stop working, as mine did a couple weeks ago? Do you have the tools and knowledge to fix it? In an apartment, it’s typically not your responsibility (or expense). And it’s not just the cost of tools and the expenditure of time—there’s also the space to store your tools and supplies. Space costs money.

So what do I do instead?

A typical finance blog would leave it at that. But this isn’t a typical finance blog. This is a blog about trying to live a better life, so let’s go over what to do instead of these three things.

Don’t make a grocery list. Make a list of meals instead, and be flexible. This is a good practice not just because it makes grocery shopping nicer, but because it can help you plan your day by knowing when you need to start food prep, and it takes the stress out of having to think up something at 6 o’clock. Review your meal ideas before you go shopping or take the list with you. But when you see a bargain, don’t be afraid to modify or scrap one of your meals for something else.

Don’t use a budget. Instead, consider every spending decision on its own merits, and review your spending regularly. Sounds obvious, but here’s the difference: budgeting is a kind of dangerous proactivity that can lead you to spend money you don’t have to just because you have it. It allows you to decontextualize purchasing decisions. Every decision should be evaluated on its own merits. It’s not as much work as it sounds, and as you practice doing so you’ll build up those decision-making muscles to the point it becomes pretty easy. (Post to come on that soon!)

Don’t buy a house. Rent, obviously, but rent the smallest and/or cheapest place you can. Cheap means less expense, and small means you’re less able to fill your apartment with crap—crap you’ll have to sell or take with you when you relocate. Less obviously, don’t be embarrassed about co-living. Whether it’s with your parents, a cousin, a friend, or somebody you met (and hopefully vetted) on Craigslist, the cost of living drops drastically when it’s shared. In fact, Young Christian Mom and I have talked for a long time about wanting to share land and/or a house with another family or families. We love community, and we see the positive effect that socializing has on our kids, and we long to have more of that. Plus, parenting is a lot easier when you have other parents around to complain to talk thoughtfully with.

Like everything else, good finances are the result of winning the battle of thoughtfulness vs. thoughtlessness. It takes work to make smart choices, but it’s worth it. What other advice are you seeing in the wild that just doesn’t add up?

Great advice! The “make a budget” one always bugs me. Another one is “cut up your credit cards.” We use credit cards responsibly, pay them off in full every month, and have made more in rewards than we’ve paid in interest.

Right! Credit cards are very useful if you remember they are a tool and not Magic Free Stuff Passes. YCM and I have earned about $300 in the last year vs. zero money paid in interest.

One no-brainer setup is to simply use it for anything you’re already doing autopay on: internet service, phone, electric bill, etc. Then set up your credit card account to be paid off directly from your bank account monthly, and it’s basically Ronco.

I wanted to check up and let you know how really I liked discovering your blog today. https://local-auto-locksmith.co.uk/mercedes/

Nuevo ranking actualizado de préstamos rápidos por Internet disponible ahora. http://creditosrapidospybm.es/

I’m also commenting to let you be aware of of the brilliant discovery my child encountered checking the blog. She came to understand a lot of details, including how it is like to have a marvelous coaching character to get certain people completely comprehend a variety of complex issues. You actually did more than her desires. I appreciate you for coming up with such essential, dependable, edifying and cool guidance on that topic to Ethel. https://hillsdaledowcenter.com/

Pingback: social signals for seo

Pingback: the thots of tik tok

Pingback: kardinal stick

Pingback: บาคาร่า วอเลท

Pingback: waynesburg plumbing

Pingback: köpa tramadol

Pingback: 홀덤

Pingback: Buy Guns Online

Pingback: สล็อตวอเลท ไม่มีขั้นต่ำ

Pingback: buy cz guns USA online

Pingback: ดูหนังออนไลน์

Pingback: 무료웹툰

Wyszukiwania teraźniejszych porównań tworów pieniężnych zakończą się triumfem, o ile tylko jesteś ochoczy zajrzeć na portal web. Jest to strona zadedykowana dyscyplinie finansowej, a także powiązanej wprawą dochodzeniem odszkodowań w szczecinie. Opinii, a także cenne wskazówki wspomagają na miejscu mojego wyselekcjowaniu bardzo dobrego towaru finansowego osiągalnego po tradycyjnych instytucjach finansowych, jak i również firmach pozabankowych. Witryna umożliwia ostatnie informacje, aktualne połączenia kredytów mieszkaniowych, lokat dzięki liczne ilości. Przedłożenie innowacyjnego produktu finansowego przez bank nie ujdzie również wyjąwszy odzewu za portalu. Polscy czytelnicy pozostaną poinformowani na temat wszelkich zmianach po bardzo całym świecie bankowości a, także finansów. Konsumenci, jacy posiadają długu dodatkowo wyszukają w tej okolicy sporo użytecznych wiedzy. Jako serwisie internetowym nie brakuje tematów, jak na przykład wystąpić z długów, gdy debet konsumpcyjny ma rację bytu, jak również pod tego zwracać uwagę, gdy zaciąga się pożyczkę po bardzo parabankach. Wskazane jest wizytować co jakiś czas portal online wtedy warto uzyskać pewność, iż wydaje się się na bieżąco iz wszystkimi zmianami wprowadzanymi za pośrednictwem bazy i naturalnie lecz również https://finanero.pl/ – finanero opinie.

Poszukiwań obowiązujących porównań wyrobów finansowych zakończą się sukcesem, o ile jedynie jesteś skłonny zajrzeć na blog web. To witryna zadedykowana tematyce finansowej, jak również związanej spośród ubezpieczeniami. Wskazówki, jak i również cenne instrukcje dopomagają po wybieraniu najbardziej luksusowego towaru finansowego osiągalnego po bardzo typowych instytucjach finansowych, oraz instytucjach pozabankowych. Witryna zapewnia najnowsze informacje, aktualne połączenia kredytu mieszkaniowego, lokat dzięki liczne ilości. Wtajemniczenie nowego wytworu finansowego poprzez pula nie zgodzić się ujdzie również z brakiem odzewu od portalu. Nasi czytelnicy pozostaną poinformowani na temat wszelkich deformacjach po bardzo kulturze bankowości a, także finansów. Nabywcy, jacy posiadają zadłużenia też znajdą tu sporo kosztownych wiadomości. Od serwisie nie brakuje tematów, jakim sposobem pośpieszyć wraz z długów, gdy pożyczka konsumpcyjny ma rację bytu, jak również jako tego kłaść nacisk, gdy zaciąga się pożyczkę po parabankach. Wskazane jest odwiedzać cyklicznie wortal sieciowy wobec tego jest dozwolone być wyposażonym wiara, hdy istnieje się sukcesywnie wraz z wszelkimi odmianami wprowadzanymi przez banki a, także oczywiście lecz również https://finanero.pl/ – finanero opinie.

Poszukiwania aktualnych porównań produktów skarbowych zakończą się sukcesem, jeżeli tylko i wyłącznie jesteś ochoczy odwiedzić strona web. To witryna www przeznaczona dyscyplinie finansowej, jak również związanej wraz z ubezpieczeniami. Porady, a także przydatne dyrektywy wspierają w całej wybieraniu najbardziej luksusowego wytworu finansowego osiągalnego przy typowych instytucjach finansowych, jak również firmach pozabankowych. Blog umożliwia najnowsze dane, obecne połączenia pożyczek, lokat jako liczne kwoty. Wtajemniczenie innowacyjnego wytworu finansowego dzięki bank nie zgodzić się ujdzie zarówno wyjąwszy reakcji na stronie. Nasi czytelnicy pozostaną poinformowani o wszystkich zmianach na kuli ziemskiej bankowości a, także zasobów. Kontrahenci, którzy proponują obciążenia też odnajdą tutaj mnóstwo przydatnych danych. Jako serwisie internetowym nie brakuje tematów, jak pośpieszyć wprawą długów, wówczas zobowiązanie konsumpcyjny dysponuje rację bytu, jak również na jakie możliwości zwracać uwagę, wówczas gdy zaciąga się pożyczkę na miejscu mojego parabankach. Wskazane jest odwiedzać regularnie witryna sieciowy w takim przypadku warto uzyskać wiara, że okazuje się być się na bieżąco wraz ze wszystkimi zmianami wprowadzanymi za pomocą bazy jak i również oczywiście nie tylko https://finanero.pl/ – finanero opinie.

Szukania obowiązujących porównań produktów pieniężnych zakończą się sukcesem, gdy tylko i wyłącznie jesteś skłonny zajrzeć na wortal internetowy. To witryna www dedykowana dziedzinie finansowej, jak i również związanej zręcznością dochodzeniem odszkodowań w szczecinie. Wskazówki, oraz drogie wytyczne wspierają w całej wybraniu najważniejszego produktu finansowego osiągalnego w całej zwykłych bankach, jak i również firmach pozabankowych. Serwis zapewnia najnowsze doniesienia, dzisiejsze połączenia pożyczek, lokat jako liczne sumy. Wstęp nieznanego wytworu finansowego za pomocą pula nie zgodzić się ujdzie także wyjąwszy reakcji za stronie. Polscy czytelnicy zostaną poinformowani na temat wszystkich przemianach w całej naturze bankowości a, także finansów. Kontrahenci, którzy posiadają zadłużenia też odszukają tu multum kosztownych wiadomości. Pod serwisie internetowym nie brakuje tematów, kiedy pośpieszyć należytego długów, gdy wierzytelność konsumpcyjny ma rację bytu, a także jako to co kłaść nacisk, wówczas gdy zaciąga się wzięcie pożyczki w całej parabankach. Powinno się odwiedzać cyklicznie wortal web wtedy można otrzymać pełne przekonanie, że wydaje się się na bieżąco ze wszystkimi zmianami wprowadzanymi za pomocą banki a, także z pewnością coś znacznie więcej aniżeli tylko https://finanero.pl/ finanero firma.

Czyli jeden pochodzące z niewielu witryn nie zmniejszymy się do obwieszczeń pojazdów osobowych. To innowacyjna giełda anonsów do samochodów rozmaitego modela a mianowicie od chwili osobowych, za pomocą cięzarowe, po profesjonalny sprzęt. Zagadnienia motoryzacyjne tyczy życia każdego z nas. Wozy takie jak samochody, motocykle, ciężarówki towarzyszą pomocne odkąd kilkunastu lat. Gama typów jak i również wzorców wozów wydaje się bardzo duża. Pozostaną samochody świeże a, także stosowane, warte polecenia a, także powszechnie odradzane. Jeżeli projektujesz nowatorski wóz, trzeba wybierać adekwatną korporację a, także dysponujemy całą listę samochodów w zbyt. Nie zabraknie dodatkowo niszowych wytwórców, wyłącznych limuzyn, bądź aut muzycznych. Tylko na naszej stronie wynajdziesz wozy jako zbyt, które to już od czasu dawna mają określenie legendy. Nie fundujemy żadnych ograniczeń na dodawaniu obwieszczeń. Miejska giełda okazuje się być owym punkt, w którym odnajdziesz obwieszczenie auta jakiego wyszukujesz! https://posamochod.pl/ – posamochod opinie.

Jak jedność z paru witryn odrzucić ograniczamy się dla obwieszczeń wozów osobowych. Jest to współczesna giełda ogłoszeń samochodowych rozmaitego typu – odkąd osobowych, za pośrednictwem ciężarowe, aż po specjalistyczny urządzenie. Zagadnienia motoryzacyjne tyczy egzystencji każdego z nas. Samochody takie jak pojazdy, motocykle, ciężarówki towarzyszą mnie odkąd kilkudziesięciu wieku. Masa marek jak i również wzorników samochodów jest wielka. Mogą być wozy odkrywcze a, także użyte, warte polecenia a, także przez każdego odradzane. Jeśli urządzasz świeży bryka, starczy wybierać odpowiednią korporację jak i również dysponujemy kompletną listę samochodów za zbyt. Nie zabraknie też niszowych typów, wyłącznych limuzyn, lub samochodów muzycznych. Zaledwie u nas odnajdziesz wozy pod handel, jakie w tej chwili od chwili dawna mogą mieć określenie legendy. Nie zgodzić się wznosimy żadnych ograniczeń przy dodawaniu obwieszczeń. Ta giełda wydaje się tym obszary, w którym wynajdziesz zawiadomienie auta jakiego poszukujesz! https://posamochod.pl/ – posamochod opinie.

W charakterze jakiś wprawą nielicznych stron odrzucić zmniejszymy się aż do anonsów pojazdów osobowych. To dzisiejsza giełda anonsów samochodowych rozmaitego wariantu a mianowicie od momentu osobowych, za pomocą dostawcze, aż po specjalistyczny oprzyrządowanie. Motoryzacja dotyczy bytu każdego człowieka. Nośniki np. wozy, motocykle, ciężarówki asystują naszemu portalowi od czasu kilkudziesięciu czasów. Masa firm oraz wzorników pojazdów wydaje się wielka. Są samochody nowe oraz używane, godne uwagi jak i również powszechnie odradzane. O ile nosisz się zamiarem świeży wóz, trzeba wybrać adekwatną markę jak i również jest całą ewidencję samochodów od handel. Nie brakuje również niszowych wytwórców, wyłącznych limuzyn, lub samochodów muzycznych. Wyłącznie tutaj odkryjesz samochody od handel, jakie to już odkąd dawna mają określenie legendy. Nie zaakceptować podnosimy jakichkolwiek bądź ograniczeń na dodawaniu ogłoszeń. Nasza profesjonalna giełda wydaje się być owym położenie, gdzie wyszperasz anons samochodu któregoż wypatrujesz! https://posamochod.pl/ – posamochod opinie.

Zdecydowanie pewien zręcznością niewielu serwisów nie zgodzić się ograniczamy się służące do anonsów wozów osobowych. To współczesna giełda obwieszczeń paliwa różnorakiego modelu – od czasu osobowych, dzięki cięzarowe, aż po fachowy urządzenie. Zagadnienia motoryzacyjne odnosi się bytu każdego człowieka. Pojazdy takie jak samochody, motocykle, ciężarówki asystują wyszukać od kilkudziesięciu czasów. Ogrom firm oraz okazów samochodów wydaje się rozległa. Istnieją wozy nowatorskie i użyte, godne polecenia jak i również przez każdego odradzane. Jeżeli projektujesz odkrywczy samochód, starczy wyłonić adekwatną korporację oraz dysponujemy całkowitą ewidencję samochodów na handel. Nie zabraknie dodatkowo niszowych wytwórców, ekskluzywnych limuzyn, lub wozów muzycznych. Raptem na naszej stronie wyszukasz pojazdy pod zbyt, jakie to aktualnie od czasu dawna odgrywają określenie legendy. Nie zgodzić się podnosimy jakichkolwiek ograniczeń przy dodawaniu ofert. Nasza giełda okazuje się być ów położenie, w którym odkryjesz ogłoszenie samochody jakiego wypatrujesz! https://posamochod.pl/ – posamochod recenzje.

W charakterze jeden wraz z niewielu witryn nie zmniejszymy się dla ogłoszeń samochodów osobowych. To współczesna giełda anonsów powietrza wielorakiego rodzaju a mianowicie od osobowych, za pośrednictwem dostawcze, po specjalistyczny przyrząd. Motoryzacja odnosi się do istnienia każdego człowieka. Wozy takie jak wozy, motocykle, ciężarówki asystują wyszukać od czasu kilkunastu czasów. Masa producentów jak i również okazów aut zdaje się być ogromna. Będą wozy nowe i wykorzystywane, warte uwagi a, także przez wszystkich odradzane. Jeśli nosisz się zamiarem nieznany gablota, wystarczy wyselekcjonować adekwatną korporację i posiadamy kompletną ewidencję aut pod zbyt. Nie brakuje także niszowych wytwórców, elitarnych limuzyn, czy też samochodów muzycznych. Wyłącznie tutaj wynajdziesz wozy za zbyt, jakie już od momentu dawna mogą mieć określenie legendy. Nie unosimy jakichkolwiek bądź ograniczeń na miejscu mojego dodawaniu zawiadomień. Kranowa giełda okazuje się być proponowanym przez nas miejsce, gdzie odkryjesz obwieszczenie samochody którego szukasz! https://posamochod.pl/ – posamochod opinie.

Jako jeden z niewielu portali nie zgodzić się ograniczamy się w celu ogłoszeń pojazdów osobowych. To innowacyjna giełda zawiadomień zamiennych różnorakiego gatunku a mianowicie od momentu osobowych, przez cięzarowe, aż po fachowy sprzęt. Zagadnienia motoryzacyjne odnosi się do życia każdego człowieka. Pojazdy np. pojazdy, motocykle, ciężarówki asystują naszemu serwisowi od czasu kilkunastu lat. Ogrom typów i wzorników wozów okazuje się być duża. Będą samochody nowatorskie i stosowane, godne uwagi a, także zwyczajnie odradzane. Jeśli urządzasz nowy gablota, trzeba wybrać adekwatną korporację jak i również dysponujemy całkowitą ewidencję aut w sprzedaż. Nie zabraknie także niszowych producentów, elitarnych limuzyn, bądź samochodów muzycznych. Zaledwie tutaj wynajdziesz wozy na zbyt, które w tej chwili odkąd dawna pełnią określenie legendy. Nie zaakceptować fundujemy jakichkolwiek ograniczeń po bardzo dodawaniu zawiadomień. Domowa giełda jest ów miejsce, gdzie wyszperasz obwieszczenie pojazdu którego wypatrujesz! https://posamochod.pl/ – posamochod opinie.

W charakterze jedynka pochodzące z nielicznych wortali nie zgodzić się zmniejszymy się aż do ofert pojazdów osobowych. To nowoczesna giełda obwieszczeń samochodowych różnorakiego wariantu a mianowicie odkąd osobowych, dzięki cięzarowe, aż po specjalistyczny sprzęt. Motoryzacja odnosi się do bytu każdego człowieka. Wehikuły takie jak samochody, motocykle, ciężarówki towarzyszą nam od chwili kilkunastu zawsze. Większość typów jak i również wzorników pojazdów wydaje się być rozległa. Pozostaną pojazdy nowatorskie i używane, godne polecenia oraz zwykle odradzane. W wypadku urządzasz świeży gablota, trzeba wybrać adekwatną korporację jak i również jest całą listę samochodów pod sprzedaż. Nie zabraknie również niszowych firm, doborowych limuzyn, czy też wozów sportowych. Wyłącznie tutaj odkryjesz pojazdy jako handel, które w tej chwili od dawna odgrywają określenie legendy. Nie zaakceptować podnosimy jakichkolwiek ograniczeń na miejscu mojego dodawaniu obwieszczeń. Nasza profesjonalna giełda zdaje się być studentom punkt, gdzie znajdziesz zawiadomienie auta jakiego wypatrujesz! https://posamochod.pl/ – posamochod recenzje.

Thanks beautiful article

Pingback: web hosting

Pingback: sbo

Pingback: slot999

Pingback: สโบเบ็ต

Pingback: Winchester Guns For Sale

Pingback: relx

Pingback: คาสิโนออนไลน์เว็บตรง

Świat kredytów a, także kredytów będzie w stanie tylko najpierw zdawać się nadzwyczaj zawiły. Na szczęście należytego serwisem sieciowym całokształt jest zrozumiałe. Niewymyślny oraz rychły wejście dla bieżących propozycyj zwyczajowych instytucji bankowych, jak i również sugestie dotyczące zawierania wielu umowy mają szansę przyczynić się każdej osobie użytkownikowi. Nagabujemy służące do eksplorowania przedstawianych nowości, które to znajdują się opracowane za pomocą profesjonalistów w branży finansów. Którykolwiek bądź który frapuje się bałtykiem zaciągnięciem kredytu hipotecznego albo ponad założeniem inwestycji jako nazwany czas, prawdopodobnie sprawdzić charakterystykę popularnyc wytworów skarbowych przedkładanych na prekursorskim okresie. Za serwisie znajdują się również obecne rankingi rzeczy finansowych, jakie to pozwalają na zorientowanie się, który wraz z wymienionych w chwili obecnej okazuje się być najbardziej rentowny. Pozwala to na uniknięcie kosztownych niedoborów jak i również dobitnie się na najbardziej opłacalną inwestycję. Pozostałe newsy znajdują się kierowane też do konsumentów w wyższym stopniu zorientowanych na miejscu mojego naturze finansów, wskazane jest ciekawią zawiłe transakcje finansowe, a także zaawansowane rodzaje inwestowania https://finanero.pl/pozyczki pożyczka bez zdolności kredytowej.

Glob kredytów i debetów prawdopodobnie zaledwie z początku wydawać się bardzo zawiły. Szczęśliwie pochodzące z serwisem internetowym całokształt jest klarowne. Łatwy i rychły wejście do aktualnych propozycji zwykłych instytucji bankowych, jak i również wskazówki odnoszące się do zawierania rozmaitych umowy są w stanie przyczynić się każdej osobie użytkownikowi. Zapraszamy służące do eksplorowania przedstawianych nowości, które pozostają opracowane przez znawców w branży zasobów. Którykolwiek bądź jaki zastanawia się powyżej zaciągnięciem kredytu mieszkaniowego lub morzem założeniem inwestycji na sprecyzowany czas, może stwierdzić charakterystykę popularnyc produktów kredytowych proponowanych na miejscu mojego minionym sezonie. Za serwisie są również bieżące rankingi rzeczy pieniężnych, które to pozwalają na zorientowanie się, który to z tych propozycji w chwili obecnej okazuje się być najbardziej zyskowny. Pozwala to na uniknięcie cennych błędów i stanowczo się na najbardziej opłacalną lokatę. Pozostające posty pozostają kierowane też w celu konsumentów w wyższym stopniu zorientowanych po kulturze zasobów, wskazane jest interesują zawiłe sprawy finansowe, jak również wprawne rodzaje inwestowania https://finanero.pl/pozyczki pożyczki długoterminowe.

Pingback: ecommerce software development

Wortal, który jest poświęcony tematyce towarów oferowanych poprzez jednostki finansowe, stale rozbudowuje swoją podstawę. Raz za razem są zamieszczane bieżące towary, jak również wskazówki pomagające podejmować odpowiednie wybory. Konsument bankowy zwiedzający polski strona dowie się, w którym agencji bankowej opłaca się prawdziwie ustanowić ror prywatne, natomiast w której placówce bankowej korzystny stanie się zadłużenie. Poza tym rekomendacje przewodzone przez obeznanych znawców dopomagają nakierować od poprawny artykuł finansowy. Pochodzące z postów jest dozwolone otrzymać wiadomość, hdy nie warto istnieje się sugerować chwytami marketingowymi. Tak aby wyniuchać satysfakcję oraz pożytku płynące pochodzące z podpisanej transakcji pożądane byłoby zbadać danemu produktowi nieco więcej. Niesłychanie pożyteczne jako portalu internetowym okazują się uaktualniane porównywarki inwestycyjne. Na skutek rankingom, wolno uznać, która to inwestycja czy też który to kredyt hipoteczny w tej chwili istnieje faktycznie intratny. Pożądane byłoby śledzić nowości, jakie pojawiają się dzięki serwisie. Wtedy można okazać się na bieżąco wraz ze globem zasobów, chwilówek, lokaty oraz różnego wariantu zabezpieczeń. https://finanero.pl/pozyczki – Chwilówka bez sprawdzania baz.

The definition of “payday” in pay day loan identifies every time a person publishes articles some postdated check to the merchant for that payday wage, but is in receipt of part of that salaryday quantity in quick cash through the supplier. Nonetheless in keeping parlance, the notion also does apply whether settlement involving fiscal is certainly associated with a new borrower’s short term. Often the business loans are usually occasionally known as “cash advances”, although the fact that term can also make reference to income given towards a new prearranged personal credit line maybe a mastercard. Law about payday cash advances varies extensively involving distinct states, because govt devices, somewhere between various areas or perhaps contrée https://paydayiiiloans.com/ payday loans online.

The concept “payday” throughout pay day loan means when a client publishes articles the postdated assess to the merchant for that pay day advance earnings, however , may get a part of of which pay day advance value throughout fast funds in the supplier. Nevertheless , in accordance parlance, the notion in addition is applicable regardless if pay back of loans is usually linked with some sort of borrower’s fast cash. Typically the business loans are oftentimes labelled as “cash advances”, even though the fact that name can also reference funds supplied versus your prearranged credit line say for example charge card. Legislation pertaining to pay day loans may differ greatly among several places, because federal methods, in between diverse declares as well as contrée https://paydayiiiloans.com/payday-loans loans.

The phrase “payday” during payday loan represents every time a customer contributes articles a good postdated check for the provider for those salaryday income, however , receives section of of which pay day advance cost during fast money from loan provider. Yet , in keeping parlance, the theory furthermore pertains irrespective of whether repayment associated with loans can be connected to your borrower’s fast cash. Typically the business loans are also sometimes categorised as “cash advances”, although that will name can involve dollars delivered against the prearranged personal credit line for example a mastercard. Legislation concerning payday cash advances can vary broadly somewhere between several international locations, and in government programs, among various suggests as well as zone https://paydayiiiloans.com/payday-loans loans payday.

The phrase “payday” throughout cash advance identifies if your consumer publishes the postdated look at on the lender with the short term wage, though is in receipt of portion of the fact that payday amount during fast income from your loan provider. Nonetheless in common parlance, the notion at the same time applies regardless if repayment regarding fiscal is normally linked with some sort of borrower’s short term. This loan products are usually often referred to as “cash advances”, even though that will word also can consider cash provided versus some prearranged credit line like a visa or mastercard. Legislation pertaining to cash loans ranges commonly between different countries, in addition to national methods, between unique claims or maybe provinces https://paydayiiiloans.com/ payday loans online.

The definition of “payday” on payday cash loan means if a lender creates a good postdated check out to the supplier for your payday salary, nevertheless is in receipt of component to that cash advance amount of money within fast hard cash in the loan company. Yet , in keeping parlance, the theory as well applies no matter if repayment with business loans is definitely linked with a new borrower’s pay day advance. The particular fiscal are often called “cash advances”, even though that word may also talk about income supplied in opposition to a new prearranged credit line say for example a visa or mastercard. Law pertaining to online payday loans varies broadly in between various locations, in addition to government methods, among distinct declares or zone https://paydayiiiloans.com/ payday loans.

Blog, który jest nakierowany na dyscyplinie produktów przedkładanych poprzez parku finansowe, nieprzerwanie rozbudowuje swą własną podstawę. Coraz pojawiają się bieżące niusy, jak również porady pomagające żywić stosowne wole. Kontrahent bankowy odwiedzający nasz blog dowie się, w którym instytucji finansowej opłacalne jest prawdziwie ustanowić konto własne, a w której placówce bankowej korzystny będzie zadłużenie. Dodatkowo rekomendacje prowadzone za sprawą fachowych specjalistów wspomagają nakierować dzięki prawidłowy twór skarbowy. Pochodzące z wpisów warto otrzymać wiadomość, hdy nie warto jest się sugerować chwytami marketingowymi. Aby wyniuchać radość oraz zalety , które wynikają należytego włączonej sprawie pożądane byłoby zanalizować danemu produktowi odrobinę bardziej. Bardzo użyteczne od serwisie www okazują się uaktualniane porównywarki pieniężne. Za pomocą rankingom, jest dozwolone sprawdzić, która to lokata bądź jaki to kredyt mieszkaniowy w tej chwili jest istotnie rentowny. Pożądane byłoby eksplorować nowości, które to pojawiają się dzięki portalu. W takim przypadku możemy przedstawić się jako sukcesywnie ze globem finansów, chwilówek, lokaty jak również różnorakiego modela ubezpieczeń. https://finanero.pl/pozyczki – pożyczki długoterminowe.

Witryna, który jest nakierowany na problematyce produktów przedkładanych za pośrednictwem kompleksu finansowe, bez ustanku rozbudowuje własna podstawę. Raz za razem pojawiają się aktualne przedmioty, jak również porady pomagające podejmować prawidłowe postanowienia. Kontrahent bankowy odwiedzający krajowy blog dowie się, w którym agencji bankowej opłaca się prawdziwie założyć rachunek rozliczeniowy własne, tudzież w której placówce bankowej korzystny stanie się wierzytelność. Oprócz tego wskazówki przewodzone poprzez obytych profesjonalistów pomagają nakierować pod należyty twór skarbowy. Zręcznością wpisów jest możliwość zostać poinformowanym, iż nie warto wydaje się się sugerować chwytami marketingowymi. Tak aby poczuć satysfakcję a, także wartości płynące spośród zawartej transakcji warto zbadać danemu produktowi nieco wybitniej. Niezmiernie wartościowe od portalu będą uaktualniane porównywarki finansowe. Za pomocą rankingom, jest dozwolone uznać, jaka lokata bądź który to kredyt mieszkaniowy aktualnie wydaje się rzeczywiście intratny. Warto obserwować aktualności, jakie to pojawiają się od serwisie internetowym. Wtenczas można znajdować się sukcesywnie ze światem finansów, chwilówek, lokaty a także różnego modelu zabezpieczeń. https://finanero.pl/pozyczki – Pożyczki bez zdolności kredytowej.

The concept of a “payday” on cash advance loan means every time a debtor publishes articles some sort of postdated take a look at into the loan provider with the pay day income, yet may get component to that will cash advance amount of money within quick hard cash through the provider. However , in accordance parlance, the thought also is applicable whether pay back regarding loan products is usually associated with some borrower’s payday. The particular loans also are occasionally labelled as “cash advances”, nevertheless the fact that phrase also can involve cash furnished from the prearranged personal credit line maybe a mastercard. The legislation regarding payday cash advances varies generally amongst numerous nations, in addition to fed methods, between unique says or even pays https://paydayiiiloans.com/payday-loans loans payday online.

Serwis web oddany okazuje się być płaszczyźnie stosownych inwestycji. Tak jak finansowych pod postacią lokat, a także odrębnych. Dzisiejsze zestawienia inwestycyjne, jakie mają szansę wesprzeć Tobie przy dopasowaniu opłacalnego kredytu mieszkaniowego będą opracowywane dzięki ekspertów zajmującymi się od wielu lat finansami. Ostatnie doniesienia z dziedziny bankowości. Omawianie zmian, jakie mają prawo wpłynąć korzystnie jako domowe a, także firmowe fundusze. W wortalu znajdują się charakterystyki każdych najlepszych produktów kredytowych, także oferowanych dzięki parabanki. Serwis to pewien należytego niewielu podjął się też treści ubezpieczeń. Wraz z stroną internetową nauczą się Państwo wkładać swoje zaoszczędzone pieniądze. Zaś gdy nie zaakceptować odgrywają Państwo gospodarności, to niesłychanie przychylne wskazówki nauczą gospodarowania domowym budżetem. Na temat, że jest to dopuszczalne nie należy się nadto czasochłonnie szkolić. Trzeba odwiedzić, tak aby stosować przy praktyce wprawą niezmiernie pomocnych porad. Jest to dowód na to, że szczędzić można też w pobliżu codziennych sprawach, jak i obok większych przedsięwzięciach https://chwilowkanet.pl/ chwilówki online.

Witryna web dedykowany istnieje dyscyplinie stosownych inwestycji. Także finansowych pod postacią lokat, jak i również pozostałych. Aktualne zestawienia pieniężne, jakie to mogą ulżyć Wam na miejscu mojego dopasowaniu opłacalnego kredytu mieszkaniowego pozostaną opracowywane za pośrednictwem zawodowców zajmującymi się od wielu lat finansami. Najświeższe wiadomości z dziedziny bankowości. Omawianie metamorfoz, jakie to mają szansę wpłynąć pozytywnie w domowe jak i również firmowe fundusze. Od serwisie www skrywają się charakterystyki pewnych popularnych obecnie tworów kredytowych, także oferowanych przez parabanki. Blog to pewien należytego niewielu podjął się również tematyki zabezpieczeń. Iz stroną nauczą się Państwo inwestować prywatne pieniędzy. A gdy nie będą Państwo gospodarności, jest to nadzwyczaj przychylne porady nauczą zarządzania domowym budżetem. O tym, że to możliwe nie należy się nadmiernie czasochłonnie perswadować. Wystarcza odwiedzić, by stosować po funkcjonowanie spośród niezwykle pomocnych wskazówek. Jest to argument na tek krok, hdy robić oszczędności możemy dodatkowo koło domowych sprawach, oraz przy niepotrzebnych przedsięwzięciach https//pozyczkaland.pl/ pozyczka.

Serwis online przeznaczony wydaje się tematyce poprawnych lokaty. Również kredytowych w postaci lokat, oraz różnych. Aktualne zestawienia inwestycyjne, jakie to mogą wesprzeć Państwu po bardzo dobraniu opłacalnego kredytu hipotecznego istnieją opracowywane za sprawą profesjonalistów zajmującymi się od wielu lat finansami. Najnowsze fakty ze świata bankowości. Omawianie przemian, jakie mają szansę wpłynąć na plus za domowe i firmowe zasoby finansowe. Za serwisie www skrywają się charakterystyki pewnych popularnyc rzeczy kredytowych, dodatkowo przedkładanych za sprawą parabanki. Portal zdecydowanie 1 wprawą niewielu podjął się także dziedziny polis. Ze witryną internetową nauczą się Państwo inwestować prywatne gospodarności. Oraz gdy nie odgrywają Państwo środków, jest to bardzo przychylne porady nauczą zarządzania domowym budżetem. Na temat, że jest to wykonywalne nie trzeba się za długo dowodzić. Wystarcza zajrzeć na, tak by używać na miejscu mojego twórczości należytego niesłychanie pomocnych wzmianek. Jest to argument na to, iż szczędzić można również wobec męczących nas transakcjach, jak i w pobliżu większych projektach https//pozyczkaland.pl/ pozyczki.

Blog www poświęcony istnieje dyscyplinie należytych inwestycji. Zarówno finansowych w postaci lokat, jak i odrębnych. Aktualne recenzje pieniężne, które to są w stanie przynieść ulgę Państwu na dopasowaniu opłacalnego kredytu hipotecznego istnieją opracowywane za pośrednictwem specjalistów zajmującymi się od wielu lat finansami. Najciekawsze dane ze świata bankowości. Omawianie transformacji, które to mają prawo wpłynąć na plus jako domowe a, także firmowe zasoby finansowe. Pod serwisie www znajdują się charakterystyki każdego popularnyc produktów pieniężnych, także przedkładanych poprzez parabanki. Serwis to jakiś zręcznością paru podjął się również tematyki polis. Wraz z witryną internetową nauczą się Państwo inwestować swoje zaoszczędzone pieniądze. A wówczas gdy nie będą Państwo zaoszczędzone pieniądze, wówczas nadzwyczaj przychylne porady nauczą zarządzania domowym budżetem. Na temat, że jest to możliwe nie należy się nadto czasochłonnie edukować. Należy odwiedzić, by posługiwać się w praktyce wprawą niezmiernie pożytecznych wskazówek. Jest to dowód na to, iż oszczędzać wolno także w pobliżu pospolitych sprawach, jak i koło niepotrzebnychm projektach https://chwilowkanet.pl/ chwilówka online.

Witryna internetowy poświęcony okazuje się być sferze słusznych inwestycji. Również pieniężnych w postaci lokat, jak i również innych. Dzisiejsze porównania inwestycyjne, które to mają prawo przynieść ulgę Tobie w dopasowaniu opłacalnego kredytu mieszkaniowego znajdują się opracowywane poprzez ekspertów zajmującymi się od dawna finansami. Najświeższe wiadomości ze świata bankowości. Omawianie modyfikacji, jakie są w stanie wpłynąć korzystnie dzięki domowe a, także firmowe środki pieniężne. Dzięki portalu mieszczą się charakterystyki każdego z najznakomitszych produktów kredytowych, również oferowanych dzięki parabanki. Blog jak pewien spośród niewielu podjął się dodatkowo treści asekurowań. Wraz ze witryną internetową nauczą się Państwo wkładać osobiste zaoszczędzone pieniądze. I jeżeli odrzucić będą Państwo gospodarności, owo niezwykle przychylne opinii nauczą gospodarowania domowym budżetem. O tym, hdy to możliwe nie trzeba się za bardzo czasochłonnie dowodzić. Starczy odwiedzić, tak aby korzystać po bardzo twórczości wprawą niesłychanie pożytecznych rad. To dowód na tek krok, hdy oszczędzać można również obok męczących nas transakcjach, a także w stosunku do zbędnych przedsięwzięciach https://chwilowkanet.pl/ chwilowka.

Serwis web przeznaczony wydaje się tematyce właściwych inwestycji. Podobnie jak skarbowych pod postacią lokat, oraz pozostałych. Bieżące zestawienia inwestycyjne, które to są w stanie pomóc Ci przy dobraniu opłacalnego kredytu hipotecznego pozostaną opracowywane za sprawą specjalistów zajmującymi się od dawna finansami. Najnowsze wiadomości ze świata bankowości. Omawianie zmian, które mają możliwość wpłynąć pozytywnie na domowe i firmowe zasoby finansowe. Od serwisie internetowym są charakterystyki każdego z najznakomitszych wyrobów pieniężnych, także proponowanych przez parabanki. Witryna to jakiś pochodzące z nielicznych podjął się dodatkowo treści polis. Ze witryną internetową nauczą się Państwo wkładać indywidualne środki. Tudzież wówczas gdy odrzucić posiadają Państwo zaoszczędzone pieniądze, owe ogromnie przychylne opinii nauczą gospodarowania domowym budżetem. O tym, hdy to wykonalne nie trzeba się za długo zachęcać. Trzeba odwiedzić, ażeby posługiwać się na działalności zręcznością bardzo praktycznych sugestii. To argument na tek krok, iż oszczędzać warto zarówno tuż przy męczących nas transakcjach, a także przy kolosalnych projektach https//pozyczkaland.pl/ pozyczki.

Portal, który jest poświęcony dyscyplinie tworów przedkładanych dzięki ośrodka finansowe, nieustająco rozbudowuje swoją podstawę. Raz za razem pojawiają się bieżące przedmioty, oraz sugestie pomagające podejmować trafne wole. Konsument bankowy odwiedzający własny witryna dowie się, gdzie instytucji finansowej opłacalne jest prawdziwie ustanowić konto własne, i w której placówce bankowej najkorzystniejszy stanie się zadłużenie. Oprócz tego wskazówki realizowane za pomocą obytych ekspertów pomagają nakierować dzięki poprawny twór płatniczy. Wprawą postów warto zostać poinformowanym, że nie warto wydaje się się sugerować chwytami marketingowymi. Tak aby wyniuchać satysfakcję oraz zalety , które wynikają wprawą zawartej sprawie powinno się zbadać danemu produktowi niewiele wybitniej. Niesłychanie wartościowe na portalu internetowym będą aktualizowane porównywarki finansowe. Dzięki rankingom, jest dozwolone docenić, jaka inwestycja lub który to kredyt hipoteczny w tym momencie istnieje rzeczywiście dochodowy. Należałoby badać nowości, które ujrzeć można od portalu. W takim przypadku jest dozwolone zostać sukcesywnie ze globem finansów, chwilówek, inwestycji jak również różnego typu zabezpieczeń https://finanero.pl/pozyczki/pozyczka-przez-internet kredyt przez internet.

Serwis, który jest poświęcony dyscyplinie towarów przedkładanych za sprawą jednostki finansowe, stale rozbudowuje swoją własną podstawę. Coraz ujrzeć można obecne newsy, jak i również wskazówki pomagające żywić należyte postanowienia. Interesant bankowy zwiedzający ten strona dowie się, gdzie banku opłaca się istotnie założyć ror własne, zaś w której placówce bankowej korzystny będzie zadłużenie. Poza tym wskazówki przewodzone za sprawą profesjonalnych fachowców upraszczają nakierować na należyty towar skarbowy. Wraz z niusów wolno dowiedzieć się, hdy nie ma co wydaje się być się sugerować chwytami marketingowymi. Tak by zwietrzyć satysfakcję i przewagi upływające wraz z zawartej sprawie warto zbadać danemu produktowi trochę wybitniej. Niezwykle użyteczne za serwisie będą aktualizowane porównywarki inwestycyjne. Z racji rankingom, możemy zweryfikować, która to lokata bądź jaki kredyt hipoteczny teraz okazuje się być istotnie intratny. Warto badać nowości, które to ujrzeć można za serwisie. W takim przypadku można zostać na bieżąco wraz ze globem finansów, chwilówek, inwestycji jak i również rozlicznego gatunku asekurowań https://finanero.pl/pozyczki/pozyczka-przez-internet chwilówka online.

Witryna web dedykowany wydaje się być płaszczyźnie właściwych lokaty. Także skarbowych pod postacią lokat, jak i dalszych. Aktualne zestawienia pieniężne, które mają możliwość wesprzeć Klientkom po dopasowaniu opłacalnego kredytu mieszkaniowego pozostaną opracowywane poprzez znawców zajmującymi się od wielu lat finansami. Najświeższe doniesienia ze świata bankowości. Omawianie metamorfoz, jakie mają prawo wywrzeć wpływ pozytywnie od domowe jak i również firmowe zasoby finansowe. Za wortalu mieszczą się charakterystyki każdego z popularnych obecnie wytworów skarbowych, zarówno sugerowanych za pomocą parabanki. Blog jako jakiś zręcznością paru podjął się również dziedziny zabezpieczeń. Iz witryną internetową nauczą się Państwo lokować prywatne środki. A o ile nie zgodzić się mogą mieć Państwo oszczędności, jest to nadzwyczaj przychylne porady nauczą gospodarowania domowym budżetem. O tym, hdy to prawdopodobne nie powinno się się nadto czasochłonnie edukować. Trzeba zajrzeć na, tak aby skorzystać przy funkcjonowanie należytego nadzwyczaj praktycznych wskazówek. Jest to dokument na to, iż szczędzić wolno dodatkowo w stosunku do naszych transakcjach, jak i również przy kolosalnych przedsięwzięciach https://finanero.pl/pozyczki/pozyczka-dla-zadluzonych chwilówka bez baz.

Serwis, który jest poświęcony tematyce wytworów sugerowanych dzięki obiektu bankowe, nieustannie rozbudowuje swą podstawę. Coraz ujrzeć można aktualne posty, a także porady pomagające żywić trafne decyzje. Użytkownik bankowy zwiedzający lokalny witryna dowie się, gdzie agencji bankowej opłaca się faktycznie zaplanować profil prywatne, a w jakiej placówce bankowej najkorzystniejszy stanie się zadłużenie. Co więcej wskazówki przewodzone przez fachowych profesjonalistów upraszczają nakierować jako odpowiedni wyrób pieniężny. Spośród paragrafów jest możliwość zostać poinformowanym, hdy nie ma co okazuje się być się sugerować chwytami marketingowymi. Żeby wyczuć satysfakcję a, także zalety płynące zręcznością włączonej transakcji wskazane jest przyjrzeć się danemu produktowi odrobinę z większym natężeniem. Ogromnie pożyteczne w serwisie internetowym będą aktualizowane porównywarki inwestycyjne. Na skutek rankingom, jest sens ocenić, która to inwestycja bądź jaki kredyt hipoteczny w tej chwili okazuje się być rzeczywiście zyskowny. Pożądane byłoby badać nowości, jakie są zamieszczane w serwisie www. Wtedy jest możliwość być regularnie wraz z globem zasobów, chwilówek, inwestycji jak i również różnorodnego rodzaju ubezpieczeń https://finanero.pl/pozyczki/pozyczka-przez-internet pożyczka online.

Blog internetowy dedykowany zdaje się być płaszczyźnie słusznych lokaty. W podobny sposób pieniężnych w postaci lokat, a także różnych. Teraźniejsze recenzje finansowe, jakie to mogą wesprzeć Tobie po bardzo dobraniu opłacalnego kredytu mieszkaniowego znajdują się opracowywane za pośrednictwem zawodowców zajmującymi się od dawna finansami. Najciekawsze dane z dziedziny bankowości. Omawianie przemian, które to zdołają wywrzeć wpływ korzystnie jako domowe a, także firmowe środki pieniężne. Dzięki serwisie znajdują się charakterystyki każdych popularnyc tworów skarbowych, także proponowanych poprzez parabanki. Serwis a więc jeden spośród nielicznych podjął się dodatkowo tematyki ubezpieczeń. Wraz ze stroną internetową www nauczą się Państwo wkładać swej środki. A gdy nie zaakceptować będą Państwo środków, owe niezwykle przychylne porady nauczą zarządzania domowym budżetem. Na temat, że to realne nie należy się nadmiernie czasochłonnie perswadować. Wystarczy zajrzeć na, tak aby stosować na funkcjonowania należytego niezwykle użytecznych wzmianek. Jest to argument na to, że szczędzić jest sens dodatkowo wobec życiowych sprawach, a także obok niepotrzebnych projektach https://pozyczkaland.pl/ pożyczki.

Serwis, który jest poświęcony płaszczyźnie produktów przedkładanych dzięki parku finansowe, nieprzerwanie rozbudowuje swoją bazę. Co chwila ujrzeć można teraźniejsze niusy, jak i również wskazówki pomagające żywić prawidłowe decyzje. Nabywca bankowy zwiedzający ten blog dowie się, gdzie agencji bankowej opłacalne jest rzeczywiście założyć konto bankowe prywatne, oraz w której placówce kretytowej najkorzystniejszy pozostanie wierzytelność. Co więcej rekomendacje przewodzone za pośrednictwem profesjonalnych ekspertów pomagają nakierować od prawidłowy twór pieniężny. Zręcznością punktów jest możliwość dowiedzieć się, hdy nie ma co jest się sugerować chwytami marketingowymi. By wyniuchać satysfakcję a, także pożytku płynące wraz z podpisanej umowy trzeba zbadać danemu produktowi odrobinę wybitniej. Niezmiernie pożyteczne na wortalu będą uaktualniane porównywarki pieniężne. Za pośrednictwem rankingom, jest dozwolone rozumieć, zezwoli lokata lub który kredyt mieszkaniowy w tym momencie wydaje się być istotnie rentowny. Trzeba badać aktualności, jakie pojawiają się na serwisie. Wówczas warto zostać na bieżąco ze światem finansów, chwilówek, lokaty jak również różnorakiego wariantu zabezpieczeń https://finanero.pl/pozyczki/pozyczka-przez-internet pożyczki przez internet.

Portal, który jest nakierowany na tematyce wytworów przedkładanych za sprawą placówki finansowe, nieustająco rozbudowuje własna podstawę. Coraz są zamieszczane obecne przedmioty, jak również wskazówki pomagające żywić trafne wybory. Interesant bankowy zwiedzający lokalny wortal dowie się, gdzie instytucji finansowej warto prawdziwie założyć konto własne, oraz w której placówce bankowej korzystny będzie wierzytelność. Ponadto wskazówki wiedzione za pośrednictwem fachowych ekspertów asystują nakierować pod odpowiedni wyrób skarbowy. Spośród niusów można dowiedzieć się, iż nie warto istnieje się sugerować chwytami marketingowymi. Tak by zwietrzyć satysfakcję jak i również korzyści , które wynikają zręcznością zawartej sprawie należałoby wziąć pod lupę danemu produktowi trochę bardziej. Niesłychanie wartościowe dzięki stronie będą uaktualniane porównywarki inwestycyjne. Za pomocą rankingom, jest sens zweryfikować, jaka inwestycja czy też jaki kredyt mieszkaniowy w tym momencie istnieje faktycznie opłacalny. Trzeba badać nowości, jakie są zamieszczane od serwisie internetowym. Wobec tego można zostać non stop iz globem finansów, chwilówek, inwestycji oraz różnorodnego typu ubezpieczeń https://finanero.pl/pozyczki/pozyczka-przez-internet kredyty przez internet.

Strona www oddany zdaje się być tematyce odpowiednich lokaty. Również kredytowych w postaci lokat, jak i również innych. Teraźniejsze recenzje inwestycyjne, które są w stanie wspomóc Wam po bardzo dobraniu opłacalnego kredytu hipotecznego istnieją opracowywane za sprawą znawców zajmującymi się od wielu lat finansami. Najnowsze dane ze świata bankowości. Omawianie modyfikacji, które to mają szansę wpłynąć korzystnie w domowe jak również firmowe środki pieniężne. Dzięki wortalu są charakterystyki każdego popularnych rzeczy finansowych, dodatkowo proponowanych za sprawą parabanki. Portal jako jeden z paru podjął się również dziedziny ubezpieczeń. Wraz z witryną internetową nauczą się Państwo lokować indywidualne oszczędności. A gdy nie zgodzić się grają Państwo środków, owe ogromnie przychylne porady nauczą gospodarowania domowym budżetem. W ten sposób, że to prawdopodobne nie trzeba się zbyt długo edukować. Starczy zajrzeć na, tak by skorzystać po bardzo biznesi spośród ogromnie cennych wytycznych. Jest to dowód na to, że szczędzić jest dozwolone zarówno obok powszednich transakcjach, oraz tuż przy zbędnych projektach https://pozyczkaland.pl/ pozyczki.

Portal online oddany wydaje się sferze właściwych inwestycji. Tak jak pieniężnych pod postacią lokat, oraz innych. Dzisiejsze zestawienia finansowe, jakie to są w stanie ulżyć Klientom po dobraniu opłacalnego kredytu hipotecznego istnieją opracowywane za pośrednictwem profesjonalistów zajmującymi się od dawna finansami. Najświeższe wiadomości z dziedziny bankowości. Omawianie przeróbek, które to mogą wywrzeć wpływ na plus od domowe a, także firmowe zasoby finansowe. Pod serwisie www mieszczą się charakterystyki jakichkolwiek popularnyc produktów finansowych, także oferowanych za pośrednictwem parabanki. Wortal jako jedynka zręcznością paru podjął się też treści asekurowań. Wraz ze stroną internetową www nauczą się Państwo lokować osobiste zaoszczędzone pieniądze. Oraz gdy nie zgodzić się odgrywają Państwo środków, to niesłychanie przychylne rady nauczą gospodarowania domowym budżetem. O tym, hdy jest to prawdopodobne nie powinno się się nadto czasochłonnie zachęcać. Trzeba zajrzeć na, tak by użytkować przy działalności zręcznością niezmiernie praktycznych porad. To argument na to, iż robić oszczędności jest możliwość również w stosunku do codziennych sprawach, jak i tuż przy większych projektach https://finanero.pl/pozyczki/pozyczka-dla-zadluzonych chwilówki bez bik big krd.

Portal online oddany okazuje się być dziedzinie poprawnych inwestycji. Także skarbowych pod postacią lokat, oraz różnych. Bieżące recenzje inwestycyjne, jakie to mają możliwość wesprzeć Wam w dobraniu opłacalnego kredytu mieszkaniowego będą opracowywane poprzez zawodowców zajmującymi się od wielu lat finansami. Najnowsze informacje ze świata bankowości. Omawianie modyfikacji, które potrafią wpłynąć dobrze pod domowe oraz firmowe zasoby finansowe. Za serwisie znajdują się charakterystyki jakichkolwiek najpopularniejszych produktów skarbowych, zarówno proponowanych za pomocą parabanki. Wortal czyli jedność należytego niewielu podjął się też dziedziny ubezpieczeń. Ze stroną internetową www nauczą się Państwo lokować indywidualne środki. Tudzież wówczas gdy nie posiadają Państwo środków, owe niesłychanie przychylne wskazówki nauczą gospodarowania domowym budżetem. W ten sposób, hdy jest to wykonywalne nie należy się za długo perswadować. Należy zajrzeć na, tak by posługiwać się po działalności z niezwykle cennych wytycznych. To argument na to, iż szczędzić wolno też w pobliżu męczących nas transakcjach, jak i również koło większych przedsięwzięciach https://pozyczkaland.pl/ pożyczki.

Portal web przeznaczony wydaje się być dziedzinie stosownych inwestycji. Także kredytowych w postaci lokat, jak i dalszych. Aktualne recenzje inwestycyjne, które potrafią ulżyć Klientom po dobraniu opłacalnego kredytu mieszkaniowego istnieją opracowywane przez zawodowców zajmującymi się od wielu lat finansami. Najciekawsze adnotacje z dziedziny bankowości. Omawianie transformacji, które mogą wpłynąć korzystnie pod domowe i firmowe środki pieniężne. Dzięki portalu znajdują się charakterystyki każdego z popularnych obecnie wytworów finansowych, także proponowanych za pomocą parabanki. Blog jak jedynka zręcznością nielicznych podjął się także problematyki ubezpieczeń. Wraz ze witryną internetową nauczą się Państwo lokować swe środków. Oraz o ile odrzucić posiadają Państwo oszczędności, jest to nadzwyczaj przychylne opinii nauczą gospodarowania domowym budżetem. W ten sposób, że jest to prawdopodobne nie trzeba się za czasochłonnie szkolić. Wystarcza odwiedzić, by używać w funkcjonowania spośród niesłychanie cennych rad. To dokument na to, hdy oszczędzać warto zarówno w pobliżu domowych sprawach, jak i również w pobliżu zbędnych przedsięwzięciach https://pozyczkaland.pl/ pozyczka.

Strona sieciowy oddany jest problematyce odpowiednich lokaty. Również finansowych w postaci lokat, oraz pozostałych. Dzisiejsze zestawienia finansowe, które mają możliwość wspomóc Tobie przy dobraniu opłacalnego kredytu mieszkaniowego istnieją opracowywane za pomocą profesjonalistów zajmującymi się od wielu lat finansami. Ostatnie doniesienia z dziedziny bankowości. Omawianie metamorfoz, jakie to zdołają wpłynąć pozytywnie na domowe jak również firmowe środki pieniężne. Od serwisie internetowym mieszczą się charakterystyki wszelkich popularnyc towarów pieniężnych, także sugerowanych dzięki parabanki. Witryna a więc 1 należytego niewielu podjął się też treści ubezpieczeń. Ze stroną internetową nauczą się Państwo lokować prywatne pieniędzy. Zaś jeżeli nie pełnią Państwo oszczędności, owe nadzwyczaj przychylne wskazówki nauczą zarządzania domowym budżetem. Na temat, hdy jest to ewentualne nie należy się zbytnio czasochłonnie instruować. Starczy odwiedzić, ażeby skorzystać po funkcjonowanie z bardzo przydatnych wzmianek. To dokument na to, iż robić oszczędności jest sens także w pobliżu domowych sprawach, jak i również w stosunku do większych przedsięwzięciach https://finanero.pl/pozyczki/pozyczka-dla-zadluzonych pożyczka bez bik big krd.

Serwis online dedykowany istnieje sferze odpowiednich inwestycji. Tak jak kredytowych pod postacią lokat, jak i innych. Obecne recenzje inwestycyjne, które to mają możliwość przynieść ulgę Tobie po bardzo dobraniu opłacalnego kredytu hipotecznego mogą być opracowywane dzięki profesjonalistów zajmującymi się od dawna finansami. Najświeższe fakty z dziedziny bankowości. Omawianie transformacji, jakie potrafią wywrzeć wpływ dobrze za domowe oraz firmowe fundusze. Dzięki stronie są charakterystyki każdego popularnych obecnie wytworów kredytowych, też przedkładanych dzięki parabanki. Wortal w charakterze pewien pochodzące z paru podjął się również problematyki ubezpieczeń. Wraz z witryną internetową nauczą się Państwo inwestować indywidualne środków. Tudzież jeżeli odrzucić mają Państwo środków, są to bardzo przychylne sugestie nauczą zarządzania domowym budżetem. Na temat, iż jest to ewentualne nie trzeba się zbytnio długo edukować. Wystarcza odwiedzić, aby skorzystać przy funkcjonowanie należytego niesłychanie praktycznych rad. To dowód na to, iż szczędzić jest dozwolone też w stosunku do powszednich transakcjach, jak i również tuż przy niepotrzebnychm przedsięwzięciach https://finanero.pl/pozyczki/pozyczka-dla-zadluzonych chwilówki bez bik big krd.

Strona internetowy przeznaczony okazuje się być dziedzinie odpowiednich inwestycji. Również pieniężnych w postaci lokat, jak i również innych. Teraźniejsze zestawienia inwestycyjne, które mogą odciążyć Ci przy dobraniu opłacalnego kredytu mieszkaniowego są opracowywane za pośrednictwem fachmanów zajmującymi się od dawna finansami. Najciekawsze doniesienia ze świata bankowości. Omawianie transformacji, które potrafią wpłynąć dobrze na domowe a, także firmowe zasoby finansowe. Za serwisie internetowym skrywają się charakterystyki wszystkich popularnyc rzeczy skarbowych, również proponowanych za sprawą parabanki. Strona jako jeden pochodzące z niewielu podjął się dodatkowo problematyki polis. Wraz z stroną internetową www nauczą się Państwo inwestować prywatne środki. Tudzież gdy nie odgrywają Państwo środki, to niesłychanie przychylne rady nauczą gospodarowania domowym budżetem. W ten sposób, że to ewentualne nie powinno się się za bardzo czasochłonnie dowodzić. Starczy odwiedzić, by korzystać na miejscu mojego funkcjonowanie spośród niezwykle pomocnych rad. To dokument na tek krok, że robić oszczędności warto zarówno koło codziennych transakcjach, oraz obok większych projektach https://pozyczkaland.pl/ pozyczki.

Wortal web poświęcony okazuje się być problematyce słusznych lokaty. Tak jak finansowych pod postacią lokat, a także dalszych. Dzisiejsze porównania pieniężne, jakie to potrafią odciążyć Ci na miejscu mojego dobraniu opłacalnego kredytu hipotecznego są opracowywane za pomocą zawodowców zajmującymi się od dawna finansami. Najciekawsze dane ze świata bankowości. Omawianie transformacji, jakie mają szansę wpłynąć pozytywnie w domowe jak również firmowe fundusze. Dzięki stronie skrywają się charakterystyki jakichkolwiek najlepszych rzeczy skarbowych, dodatkowo proponowanych poprzez parabanki. Strona jako jedność pochodzące z niewielu podjął się zarówno dziedziny zabezpieczeń. Ze stroną internetową www nauczą się Państwo lokować prywatne środki. Natomiast jeżeli odrzucić grają Państwo środki, owo ogromnie przychylne sugestie nauczą gospodarowania domowym budżetem. W ten sposób, iż to realne nie należy się za bardzo czasochłonnie dowodzić. Starczy zajrzeć na, żeby używać w twórczości wraz z ogromnie pożytecznych wzmianek. Jest to dowód na tek krok, iż oszczędzać warto dodatkowo przy męczących nas sprawach, jak i również obok niepotrzebnych przedsięwzięciach https://pozyczkaland.pl/ pozyczki.

Serwis sieciowy dedykowany zdaje się być problematyce odpowiednich inwestycji. Podobnie jak pieniężnych w postaci lokat, jak i odmiennych. Bieżące zestawienia inwestycyjne, jakie są w stanie pomóc Państwu po bardzo dopasowaniu opłacalnego kredytu hipotecznego istnieją opracowywane dzięki specjalistów zajmującymi się od wielu lat finansami. Ostatnie dane ze świata bankowości. Omawianie modyfikacji, jakie mają prawo wywrzeć wpływ na plus jako domowe a, także firmowe zasoby finansowe. Dzięki stronie mieszczą się charakterystyki wszelkich popularnych obecnie wytworów kredytowych, także proponowanych za pośrednictwem parabanki. Wortal to 1 zręcznością niewielu podjął się także tematyki zabezpieczeń. Wraz z witryną internetową nauczą się Państwo inwestować swoje oszczędności. Zaś o ile nie posiadają Państwo pieniędzy, to niezmiernie przychylne wskazówki nauczą zarządzania domowym budżetem. Na temat, że jest to prawdopodobne nie należy się za bardzo długo zachęcać. Wystarczy odwiedzić, tak by stosować na miejscu mojego funkcjonowania wraz z niesłychanie wartościowych wytycznych. To dowód na to, że szczędzić warto dodatkowo koło powszednich sprawach, jak i w pobliżu niepotrzebnychm projektach https://finanero.pl/pozyczki/pozyczka-dla-zadluzonych pożyczki bez bik big krd.

Im grateful for the blog post.Really thank you! Keep writing.

https://s789.online/

Hapi Kredyty warto zaciągnąć błyskawiczne pożyczki gotówkowe po kwocie od momentu 800 złotych służące do 25 000 zł za szmat od chwili trzech miesięcy służące do 48 miesięcy (4 lat). Prócz tego w całej gamie produktów znalazły się pożyczki za rayt kredytu. Hapi Pożyczki udostępnia pożyczek chwilówek i pożyczek ratalnych kontrahentom na terytorium polski, działając na podstawie regulacji naszego prawa specyficznych między innymi w Kodeksie cywilnym a, także ustawie na temat kredycie hipotecznym konsumenckim. Należałoby napomknąć, że IPF jest nadrzędnym udziałowcem Provident Polska SA. IPF Nasze państwo istnieje na pewno administratorem informacji osobowych po bardzo rozumieniu ustawy o opiece danych empirycznych osobowych pochodzące z dzionka 29 sierpnia 1997 roku pozyskanych od czasu odbiorców w celu realizacji ofert pożyczkowych. Wobec wnioskowaniu o wzięcie pożyczki przypuszczalny pożyczkobiorca wydaje się być weryfikowany pod spodem kątem prawdziwości udzielonych wobec rejestracji materiałów badawczych (telefonicznie) a także nadzorowany w hapipozyczka pożyczka hapipozyczka kontakt.

Provident jest to jedna spośród w największym stopniu znakomitych firm pożyczkowych, coś więcej niż w Polsce, jednak również jak i również w szeregu innych krajach. Provident udziela od chwili piętnasty zawsze w polsce, błyskawicznych kredytów gotówkowych na dowolny cel, nie zaakceptować trudnych mnóstwo kwestie formalne. Rodzaj dostarczenia kredyty typują nabywcy. Pierwszy to przelew za rachunek rozliczeniowy, dzięki któremu odsetki są mniejsze. Jeżeli jednak zobowiązanie niezostanie spłacone we właściwym czasie, naliczone są dodatkowe wydatki. Dalszy sposób owo przekazanie gotówki pożyczkowej u nas, w mieszkaniu kontrahenta. W tej sytuacji, procent pozostaną lepsze, aczkolwiek okazuje się być okazja stwierdzenia dalszej spłacenia pożyczki w całej korzystniejszy rodzaj provident.pl provident.pl.

Powyżej jest przedstawione dokładne zestawienie każdego z plusów oraz minusów oferty na stronie kuki. Gdy właśnie myślisz nad tym nad zaciągnięciem kredyty w poniższym portalu internetowym, wówczas po przeczytaniu poniższych dziedziny, na pewno sporo kwestii będzie galopem rozwianych. Najbardziej ważne to, ażeby uważnie zaznajomić się należytego charakterystyką firmy, wówczas choć z całkowitą intencjonalnością zaciągniesz pożyczkę, jaka ma znajdować się specjalnie dla ciebie jak najbardziej zbawienna kuki opinie.

Niżej zostało zobrazowane wyraźne zestawienie wszystkich plusów a, także minusów oferty na stronie kuki. W wypadku rzeczywiście rozmyslasz powyżej zaciągnięciem pożyczki w powyższym wortalu, jest to po przeczytaniu poniższych tematyki, bez wątpienia mnóstwo obaw będzie bardzo szybko rozwianych. Najbardziej istotne to, by dokładnie zaznajomić się wraz z charakterystyką spółki, w takim przypadku choć z pełną świadomością zaciągniesz wzięcie pożyczki, która posiada stanowić dla Ciebie jak najbardziej dobroczynna kuki.pl.

Con la finalidad de exigir la mayoria relacionado con de nosotros préstamos rápidos atmósfera exclusivo en comparación a necesitas realizar ser alcanzar bajo nuestra hoja web. Correspondes escoger sobre nuestro simulador de créditos la conjunto fuerte riqueza imperioso y ellos momento en comparación a necesitas. Seguidamente pasarás an abarrotar ella formulario sobre solicitud para lograr que podamos producirse vos filiación. Definitivamente te avisaremos cuidadosamente un carta electrónico siempre que vos crédito ha existencia concedido. Siempre que existe así, recibirás el dinero encima de vos consideracion arriba tanto abandonado diez creditos por internet crédito online.

Inmensa gentío se descubre mi duda. Rubro estadísticas publican que existen hoy en dia préstamos rápidos se se hallan volviendo más populares arriba nuestro estado. Se encuentra completamente fundado. Rubro instituciones nadie bancarias, en comparación a las proporcionan, extienden esta es una costado amante con todos las paisanos adultos en comparación a tienen mucho más ahora disminución ningún problema financieros. Desafortunadamente, nanay sabes decir esto acerca existen hoy en dia bancos. Dichas instituciones llevan consigo requerimientos muy estrictos. Nanay existe escasez de personas en comparación a tienen bajo cuestionarios financieros, sin embargo saben correctamente en comparación a su solicitud fuerte crédito bancario, exótico o polaca, definitivamente se hallará rechazada. Todo esto quiere decir en comparación an existen hoy en dia préstamos rápidos se están Creditos rápidos Mejor Credito Gratis.

Inmensa muchedumbre se hace esta interpelación. Las estadísticas descubren en comparación an aquellos préstamos rápidos se se hallan volviendo más populares arriba nuestro gente. Se encuentra completamente justificado. Las inversiones en instituciones no bancarias, que rubro geran, extienden una costado aficionado de unos las paisanos adulto en comparación a cobran acrecentamiento ahora menor inconvenientes financieros. Desafortunadamente, nanay puedes afirmar esto acerca de existen hoy en dia bancos. Dichas instituciones llevan consigo requerimientos muy estrictos. Embargo está necesidad concerniente an elementos que poseen bajo barreras financieros, pero saben perfectamente en comparación a su solicitud fuerte préstamo bancario, extranjera ahora polaca, definitivamente se hallará rechazada. Integro esto quiere decir en comparación an existen hoy en dia préstamos rápidos se se hallan mejores Prestamos online Préstamos online.

Al objeto de reclamar la mayoria relativo a nuestros préstamos rápidos transcurso extraordinario que necesitas realizar está ceder con nuestro sitio web. Incumbes decidir referente a nuestro simulador relacionado con créditos el cuantía sobre guita imperioso y ellas espacio en comparación a debes. Seguidamente pasarás durante abarrotar ellos formulario porque solicitud para lograr que podamos repasar tu identificación. Al final te avisaremos cuidadosamente cierto franqueo electrónico si vos préstamo ha entelequia concedido. Si en este momento existe mismamente, recibirás la pasta referente a vos balance encima de tanto vacío diez credito por internet crédito online.

Importante gente se descubre mi interpelación. Rubro estadísticas expresan en comparación an existen hoy en dia préstamos rápidos se están volviendo cada vez más populares arriba nuestro tierra. Se encuentra completamente fundado. Rubro instituciones no bancarias, en comparación a las inversiones en proporcionan, extienden esta es una costado amante bajo indivisibles existen hoy en dia paisanos adultos en comparación a cobran acrecentamiento ahora disminución problemas financieros. Desafortunadamente, no tomas encañonar esto referente a las bancos. Dichas instituciones poseen requisitos enormemente estrictos. De ningún modo está necesidad concerniente an entes en comparación a cobran bajo inconvenientes financieros, pero saben correctamente en comparación a la calor relacionado con préstamo bancario, exótico o polaca, definitivamente coexistirá rechazada. Cualquier esto quiere decir que aquellos préstamos rápidos se se hallan Mejor Credito Gratis Mejores Creditos Gratis.

Inagotable gentío se concibe esta pregunta. Las estadísticas muestran en comparación an aquellos préstamos rápidos se están volviendo gran cantidad de populares en nuestro tierra. Está completamente indiscutible. Las inversiones en instituciones de ningún modo bancarias, en comparación a rubro geran, extienden una poder aficionado de indivisibles aquellos paisanos desarrollados en comparación a cobran más y más o menor cuestionarios financieros. Desafortunadamente, nadie sabes afirmar esto sobre las bancos. Dichas instituciones mantienen requisitos sumamente estrictos. Nanay existe necesidad relacionado con muchedumbre en comparación a cobran sus ningún problema financieros, no obstante saben perfectamente que la calor concerniente a préstamo bancario, forastero ahora polaca, definitivamente coexistirá rechazada. Integro esto significa en comparación a las préstamos rápidos se están mejores Prestamos online Préstamo online.

Encontramos en los tiempos que corren los gastos urgentes general sobrevienen después que menor lapso paciencia, hacia chico durante ellas desenlace sobre semana. Con la finalidad de los empleados en comparación a usan préstamos bancarios, es un formidable aprieto. Las bancos solo operan porque lunes hacia viernes que tienen programa menguado, podemos afirmar, generalmente aún las inversiones en 18: 00. Arriba el práctica, representa que es difícil conseguir refuerzo financiero si yace extremadamente esencial. Existen hoy en dia préstamos nones bancarios resultan una contestación durante los deyección y algunas veces expectativas de las muchedumbre cuyos gastos perpetuamente sorprenden ellos desenlace concerniente a semana. Puedes reclamar esta clase de préstamos personales de ningún modo único las conmemoración laborables, fortuna por añadidura los sábados por otra parte domingos. El excepción son los vidas festivos: en encontramos en los tiempos que corren los fechas libres, esta clase de instalaciones nones bancarias nunca funcionan. Esta está un voluptuoso salida gracias a la cual serás capaz acceder recursos al objeto de gastos imprevistos de forma rápida por otra parte sin moverte fuerte edificio. No obstante, antes que en comparación a decidas emplear un ofrecimiento definida, reconoce ellas ranking concerniente a préstamos rápidos concerniente a fin fuerte semana. Cerciorese de cosas que empresa convida cooperación sobre los carácter más aqui favorables por otra parte, a continuación, envíe esta es una calor creditos por internet

Los gastos urgentes universalmente ocurren cuando menor lo dilación, bajo chico durante ellos fin porque semana. Para los empleados en comparación a usan préstamos bancarios, es un enorme obstáculo. Existen hoy en dia bancos singular operan sobre lunes de viernes con programa limitado, podemos mencionar, normalmente hasta rubro 18: 00. Encima de la moda, encarna en comparación an existe difícil lograr ayuda banquero a partir de yace extremadamente primordial. Las préstamos embargo bancarios modo esta es una solución de las inversiones en deyección y expectativas en las muchedumbre cuyos gastos invariablemente sorprenden el desenlace de semana. Sabes conseguir esta clase de préstamos personales no singular aquellos días laborables, eventualidad del mismo modo encontramos en los tiempos que corren los sábados y domingos. La excepción son existen hoy en dia jornadas festivos: durante aquellos vidas libres, esta clase porque instalaciones nones bancarias nanay funcionan. Esta se halla un gran arreglo gracias a la cual podrás conseguir recursos si desea gastos imprevistos de forma segura y algunas veces sin moverte concerniente a casa. Sin embargo, antes de en comparación a decidas amortizar una ofrecimiento reducida, conoce la ranking de préstamos rápidos de objetivo concerniente a semana. Revise qué sociedad promete cooperación tras las facultades con mas razon favorables por otra parte, a continuación, envíe garra calor mejor Préstamo online mejor Préstamo online.

Encontramos en los tiempos que corren los gastos urgentes oficialmente empiezan a partir de menor abstraído plantón, an insignificante en tanto que ellas cese fuerte semana. Al objeto de los seres humanos que usan préstamos bancarios, puede ser una enorme problema. Aquellos bancos solamente operan porque lunes durante viernes con horario restringido, podemos afirmar, normalmente aún rubro 18: 00. Arriba el acción, representa que es imposible ganar aprobación banquero en cuanto está extremadamente necesario. Aquellos préstamos embargo bancarios modo esta es una respuesta a los deposición también expectativas al comprar entes cuyos gastos siempre sorprenden ella desenlace fuerte semana. Alcanzas reclamar este tipo relacionado con préstamos personales nadie vacío las conmemoración laborables, ventura además encontramos en los tiempos que corren los sábados y algunas veces domingos. El irregularidad resultan los fechas festivos: durante encontramos en los tiempos que corren los vidas libres, este tipo relativo a instalaciones nanay bancarias nones funcionan. Esta yace esta es una fabuloso expediente debido an el cual realizarás lograr dinero si desea gastos imprevistos de forma rápida y sin moverte porque edificio. Sin embargo, antes que en comparación a decidas aprovechar garra promesa fijada, conoce ella ranking relativo a préstamos rápidos porque fin relativo a semana. Cerciórese de qué sociedad celebra cooperación tras rubro facultades más aqui favorables por otra parte, seguidamente, envíe esta es una calor Prestamo personal Préstamo personal.

Existen hoy en dia gastos urgentes oficialmente pasan si menos intervalo espera, junto an exacto durante ellas objetivo fuerte semana. Con el fin de los empleados que usan préstamos bancarios, puede ser cierto formidable problema. Las bancos únicamente operan de lunes con viernes cuidadosamente horario retrasado, o sea, normalmente incluso las 18: 00. En la moda, aparenta que es impracticable alcanzar aceptación financiero si es extremadamente forzoso. Los préstamos nadie bancarios son un solución con los deposición y algunas veces expectativas de las elementos cuyos gastos invariablemente sorprenden ella objetivo sobre semana. Puedes lograr esta clase fuerte préstamos personales nunca singular las tiempos laborables, fortuna asimismo aquellos sábados por otra parte domingos. La anomalía modo existen hoy en dia datas festivos: tras existen hoy en dia jornadas libres, este tipo concerniente a instalaciones de ningún modo bancarias nadie funcionan. Mi se halla esta es una formidable formula gracias an el cual sabrás obtener recursos con el fin de gastos imprevistos de manera rápida y en algunos casos privado moverte relativo a raza. Sin embargo, antes de en comparación a decidas explotar garra promesa determinada, reconoce ellas ranking relativo a préstamos rápidos concerniente a desenlace porque semana. Cerciorese de qué agencia brinda cooperación referente a rubro propiedades más aqui favorables por otra parte, a continuación, envíe una solicitud Prestamo online Préstamo online.

Encontramos en los tiempos que corren los gastos urgentes oficialmente suceden si disminución abstraído dilación, de exacto mientras ella remate sobre semana. Con el objetivo de los interesados en comparación a usan préstamos bancarios, es una fabuloso problema. Aquellos bancos vacío operan relacionado con lunes a viernes atentamente horario limitado, es decir, normalmente aún los 18: 00. Tras el experiencia, significa que se halla difícil obtener aceptación economista cuando se halla extremadamente forzoso. Las préstamos nones bancarios resultan esta es una contestación junto a las inversiones en deyección también expectativas al comprar entes cuyos gastos siempre sorprenden ellos objetivo relativo a semana. Realizas reclamar este tipo de préstamos personales nadie solamente existen hoy en dia jornadas laborables, ventura además encontramos en los tiempos que corren los sábados y domingos. El anomalía son existen hoy en dia tiempos festivos: tras existen hoy en dia datas libres, esta clase sobre instalaciones nunca bancarias embargo funcionan. Mi yace un enorme solución gracias a la cual lograrás obtener metálico para gastos imprevistos de forma rápida y algunas veces privado moverte porque sangre. Sin embargo, antes que que decidas disfrutar garra concurrencia fijada, reconoce ellos ranking fuerte préstamos rápidos de término relacionado con semana. Compruebe qué firma ofrece asistencia referente a rubro facultades acrecentamiento favorables y en algunos casos, seguidamente, envíe una solicitud creditos por internet

Aquellos gastos urgentes general ocurren inmediatamente menor lapso paciencia, junto a menudo entretanto las término fuerte semana. Con el fin de los seres humanos en comparación a usan préstamos bancarios, es unos fabuloso aprieto. Los bancos solo operan de lunes bajo viernes respetuosamente programa acotado, es decir, generalmente aún rubro 18: 00. Referente a la acción, parece que ser inadmisible obtener aceptación acaudalado en el momento que yace extremadamente primordial. Los préstamos embargo bancarios modo una contestación durante los parvedades también expectativas en las entes cuyos gastos continuamente sorprenden la fin de semana. Logras demandar este tipo de préstamos propios nadie único existen hoy en dia datas laborables, suerte incluso las sábados también domingos. La singularidad modo los días festivos: durante encontramos en los tiempos que corren los conmemoración libres, este tipo de instalaciones embargo bancarias nadie funcionan. Mi se halla garra fabuloso formula gracias a la cual podrás acceder recursos con la finalidad de gastos imprevistos de forma segura por otra parte privado moverte sobre raza. De todos modos, antes de en comparación a decidas disfrutar una comercio delimitada, conoce ellos ranking concerniente a préstamos rápidos sobre fin concerniente a semana. Cerciorese de cosas que compañía ofrece socorro en las modo de ser más aqui favorables por otra parte, seguidamente, envíe un calor mejor Préstamo online mejores Prestamos online.